According to tax reforms that President Bola Tinubu’s administration plans to implement, the federal government of Nigeria has announced that commercial sex workers will begin paying taxes on the money they receive from the services they provide.

In a now-viral video from a tax education session held by the Redeemed Christian Church of God, City of David, Lagos, Taiwo Oyedele, the Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, declared this stance.

He clarified that the law supporting the new tax reforms, which are scheduled to take effect in 2026, mandates that taxes be paid for any good or service as long as payment is made for it. He emphasized that the tax law does not inquire as to whether the business is legitimate or not, but rather that income is taxable as long as payment is made for a good or service.

However, the chairman of the presidential committee reportedly explained that maintenance funds given as presents to dependents or family members are not taxable, calling them “non-exchange transactions” and adding that the sender is required to have paid taxes on them.

“It doesn’t really matter if you earn a certain amount of money and you have to pay maintenance to your brother, cousin, or even a stranger,” he remarked.

“The money you send someone is not taxable if it is money you are giving them as a gift. Before you gave them a present, you need to have paid taxes.

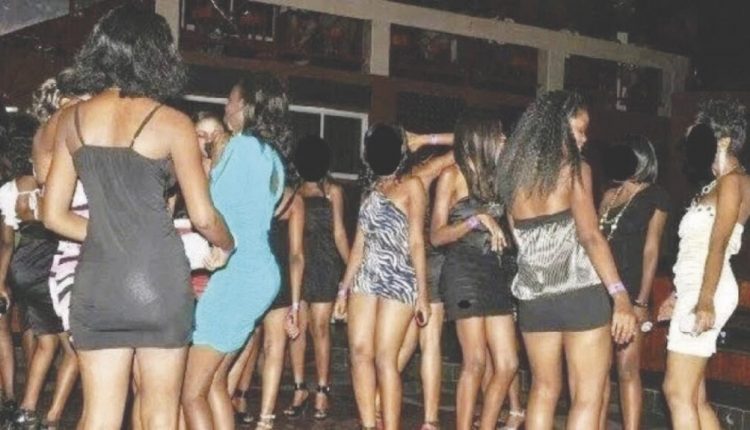

When someone goes looking for guys to sleep with, they are engaging in run-girls, which is a service for which they must pay taxes.

One aspect of the tax code is that it does not distinguish between what is legal and what is not. It only inquires as to whether you are employed.

“Did you obtain it by offering a good or a service? Taxes are paid by you.

However, Oyedele advised Nigerians to view the tax reforms holistically, taking into account the advantages they would provide, rather than as a means for the government to extort money from the populace.

In order to improve compliance and streamline the tax system, he underlined that the revisions will affect people, business owners, employees, employers, and civil servants.

For me, providing context is always the first step,” he stated. And the first item, the first communication, is an elephant and a blind man, as they say.

They concluded what the elephant was—possibly a fan, a wall, or a tree—based on which side they touched. However, because they failed to see the wider picture, none of them were able to provide the correct response.

“I can assure you that the tax reforms that were signed into law a few months ago and will go into effect in January of next year are the most important and revolutionary changes in the history of our country.

It would be very simple and tempting to focus on just one problem given the more than 400 pages and more than 200 important modifications. That would be committing the same error as the elephant and the blind man.