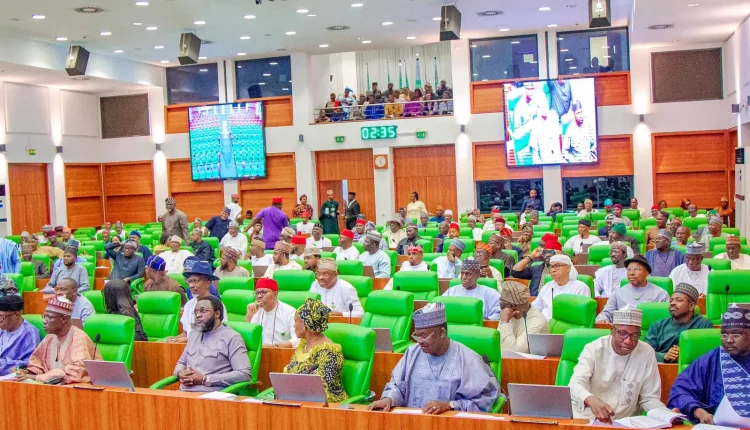

Excessive Charges: Reps Committee Gives Commercial Banks 4-Day Ultimatum to Submit Deduction Records

Commercial banks operating in Nigeria have been given four days to submit all requested documentation regarding their charges by an Ad-hoc Committee of the House of Representatives that is looking into the deduction of taxes and other charges from the earnings of civil and public servants as well as numerous bank charges on customers’ accounts in Nigeria.

Additionally, the House probe panel rejected any bank CEO’s representation without a properly signed authorization letter to the panel and demanded that the CEOs of major financial institutions appear at the investigative hearing.

In a statement made at the start of the House panel session on Tuesday in Abuja, the chairman of the House Committee, Hon. Kelechi Nwogu, stated that the House investigative panel is required to make sure that all bank deductions of charges on customers’ accounts are properly used and fined.

He added that the Ministry of Finance, the Office of the Accountant-General of the Federation (OAGF), the Economic and Financial Crimes Commission (EFCC), and commercial banks doing business in Nigeria had all been invited to participate in the probe by the House Committee.

During the probe, members of the House Committee claimed that commercial banks were breaking the law by taking mysterious fees out of the bank accounts of public employees, civil workers, and other clients without sending any money back.

The chairman of the House Committee and a few members who refused to allow the CEOs of GT Bank, Zenith Bank, Access Bank, and other commercial banks to be represented cannot hold water because they maintained that they must consistently appear before the panel.

“You cannot appear here without an identity,” he stated. We’re not here by ourselves. The people who elected us to parliament gave us this mandate.

We have decided to meet on Wednesday of next week. All needed documentation must be sent in by Monday at the latest.

“We’ll review all the paperwork and put you under oath.”

If we ask you back and you give us the same tale, it won’t be good. Any bank that does not present the required paperwork by Monday will be sanctioned, according to our deadline.

The House Committee Chairman stated that every effort is being made by the House panel to determine the reasons behind the commercial banks’ fraudulent charges on their clients’ accounts.

During the hearing, other panel members, including Hon. Chidi Mark Obeta and Hon. Engr. Dominic Okafor, spoke in favor of the requirement that the bank CEOs consistently appear before the panel.