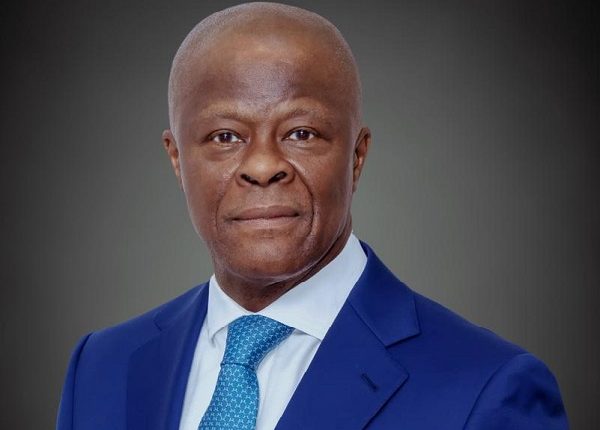

Nigeria is starting to see the tangible results of a number of challenging but essential changes that are changing the country’s economic landscape, and Wale Edun, the Minister of Finance and Coordinating Minister of the Economy, is largely responsible for this development. Under his leadership, the country has started to transition from years of fiscal hardship and policy ambiguity to a more stable, open, and growth-oriented framework that is winning back trust both domestically and internationally.

Nigeria’s economic recovery is not a coincidence. As Minister of Finance and Coordinating Minister of the Economy, Wale Edun has carefully and patiently guided an ambitious, well-organized agenda of reforms and institution creation. The cumulative effect of complementary policy actions that collectively have decreased distortions, enhanced openness, and reopened corridors of international confidence is what is remarkable rather than a single noteworthy accomplishment.

Edun’s strategy has blended political discernment with technological precision. In addition to safeguarding priority spending, bolstering revenue management, and reestablishing the integrity of financial institutions, he has emphasized on restoring fiscal credibility. When combined, these actions are already producing quantifiable, although incremental, gains and have started to alter how partners and markets view Nigeria. Though they are only a portion of the narrative, recent international evaluations and market responses are helpful indicators of that development.

Investors and international organizations are already observing the effects of this change. Nigeria’s GDP growth prediction for 2025 was recently raised by the International Monetary Fund from 3.4% to 3.9%. The IMF claims that increased oil output, enhanced investor confidence, and a more robust fiscal policy environment are all reflected in this revision. These advancements are not coincidental. They result from the government’s unambiguous determination, under Edun’s leadership, to enhance debt sustainability, reinstate macroeconomic discipline, and bolster cooperation between monetary and fiscal institutions. The upgrading is an endorsement of Nigeria’s economic reforms and the legitimacy of its leadership group.

Nigeria’s official removal from the Financial Action Task Force’s (FATF) “grey list” in October 2025 was another noteworthy milestone. The FATF is a global blacklist for nations that are being closely watched for inadequacies in their efforts to prevent money laundering and terrorism funding. Nigeria’s improved interagency coordination and reform advancements were recognized by the FATF as key factors in its ruling. In order to improve financial transaction transparency, modernize financial crime monitoring systems, and fortify compliance frameworks, the Ministry of Finance collaborated closely with the Central Bank of Nigeria, the Nigerian Financial Intelligence Unit, and other authorities under Edun’s direction.

This accomplishment has broad ramifications. It is anticipated that Nigeria’s removal from the grey list will facilitate international financial transactions, enhance correspondent-banking ties, and lower the cost of foreign capital. Investors see it as an indication of a more secure, regulated corporate environment. It translates into more opportunities for economic inclusion, job development, and investment inflows for residents. In summary, it is a technical and symbolic win for a government that wants to restore confidence in Nigeria’s economic management.

Edun’s ability to create and implement a cogent reform plan that balances economic responsibility with openness and creativity has been fundamental to his success. In order to provide better value for money, his ministry has prioritized expanding Nigeria’s income base through non-oil sectors, enhancing tax administration, and streamlining governmental spending. The main objective is to make the economy more responsive to the needs of its citizens and less susceptible to shocks from the outside world.

Edun and his team described how a renewed sense of purpose centered on modernizing public financial management systems, bolstering institutional capacity, and encouraging accountability at all levels is driving reforms in a recent reflection titled “Nigeria Turning Towards Prosperity” published by the Federal Ministry of Finance. The focus on systemic reform is progressively increasing confidence among investors and development partners as well as among regular Nigerians who are starting to notice signs of responsible government.

However, Edun has frequently admitted that there are obstacles in the way of success. Infrastructure deficiencies continue to impede productivity, inflation is still a major problem, and more needs to be done by the government to guarantee that growth results in higher living standards. However, the government has set the groundwork for inclusive and long-lasting success by tackling these structural problems through uniform policy execution and cross-institutional cooperation.

A subtle but profound shift in Nigeria’s economic story is taking place. The nation is regaining its position as one of Africa’s top economies because to a mix of sound fiscal management, improved institutions, and trustworthy interactions with foreign partners.

Wale Edun has shown both technical expertise and political bravery in a time when economic policymaking need both. He has assisted in guiding Nigeria along a path of recovery and restored international trust by placing a high priority on fiscal credibility, transparency, and institutional change. Nigeria’s economy is stabilizing, investor mood is improving, and the prospect of shared prosperity is once again within grasp, despite ongoing hurdles.

The goal of these reforms is to revive faith in Nigeria’s story—one of resiliency, reform, and renewal—rather than only focusing on statistics and forecasts. His leadership has demonstrated that the Nigerian economy can, in fact, turn the corner towards sustainable growth and long-term prosperity with the correct leadership, sensible policies, and transparent accountability.

Decisive policy decisions, institution-building, and cautious reform sequencing are responding to a time of persistent imbalances and diminished investor confidence. Better international ratings, a more transparent macroeconomic framework, and a gradually expanding foundation for sustainable growth are the outcomes.

Wale Edun’s function in this process has been to connect the political and the technical. Only when politicians handle communication and sequencing with the same attention as they do the substantive policy decisions will reform be successful. Edun has worked to modernize tax procedures, fortify institutions in charge of financial integrity, and make the economy more accessible to private investment while maintaining fiscal credibility. The outcome is a reform architecture that gives institutional longevity and technological remedies equal weight. This combination has been crucial to obtaining the IMF improvements, the FATF delisting, and revived investor interest, according to observers who monitor policy implementation.

The priorities are evident while looking ahead. To maintain the FATF delisting, combine advances in financial supervision and anti-money laundering. Expand the income base by significantly modernizing taxes and customs. Reforms that encourage private infrastructure investment should be accelerated because governmental resources are insufficient. Additionally, make sure that social protection is properly targeted to promote inclusive growth. These responsibilities necessitate ongoing policy discipline, improved federal and state delivery capabilities, and constant engagement to the public and private sectors.

Nigeria’s current state is the result of deliberate planning and difficult decisions. Wale Edun has played a key role in both that design and the patient diplomacy required to convert technical innovations into a national strategy that can be trusted. The FATF ruling and the IMF modification are significant indicators, but they also point to a more significant result: Nigeria is reconstructing the framework of contemporary economic governance. The economy as a whole will gain in the long run if that architecture is maintained and strengthened.

The following noteworthy areas sum up the reform’s successes:

strengthening the structure and development of GDP

Growth has returned to positive territory because to Edun’s strong reforms. For example, real GDP increased from 2.31 percent in the first quarter of 2023 to 2.98 percent in the first quarter of 2024. Nigeria then reported 3.13% growth in the first quarter of 2025, indicating an upward trend. The underlying pattern is one of recovery from stagnation and renewed vitality, even if annual growth in 2023 was 2.74 percent, up from 3.10 percent in 2022.

Beyond the headline rate, the structure of output is starting to change in favor of more contemporary sectors due to changes bolstering the services and industry sectors, such as the gradual liberalization of downstream oil, tax reform, and institutional improvements.

Reducing the strain on inflation

Although data show a distinct disinflationary trend, which suggests that policy frameworks are regaining traction, inflation is still a problem. The National Bureau of Statistics reports that headline inflation decreased from 22.22 percent in June to 21.88 percent in July 2025. More generally, according to trading-economics data, inflation was 18.02% in September 2025, a decrease from more than 20% the previous month. In summary, there is policy room for interest-rate moderation and household relief as the inflation tidal seems to be gradually retreating.

bolstering external reserves and buffers

The recovery of Nigeria’s foreign exchange reserves and external buffer is a crucial, frequently overlooked reform under Edun’s purview. At the end of 2024, the Central Bank of Nigeria recorded net foreign exchange reserves of US$23.11 billion, the largest amount in three years. Gross external reserves increased from US$33.22 billion to almost US$40.19 billion in December 2024. More recently, reserves reached their greatest level since December 2021 in August 2025, surpassing US$41 billion. These reserve increases boost investor confidence, strengthen Nigeria’s ability to withstand external shocks, and strengthen its currency defense capability.

Reform architecture, institutional strengthening, and policy coherence

A cogent reform framework is at the core of these advancements. (i) fiscal consolidation and the rationalization of subsidies; (ii) revenue mobilization and tax modernization (including mandatory e-invoicing for large taxpayers, digital tax systems); (iii) public financial management reform, debt-portfolio rationalization, and transparency enhancements; and (iv) institutional and regulatory strengthening—particularly in financial-crime supervision, anti-money-laundering mechanisms, and foreign-exchange market liberalization. For instance, these institutional changes served as the foundation for Nigeria’s October 2025 FATF grey-list delisting.

These changes are not merely surface-level. By design, they improve ratings, lower risk premia for investors, increase the legitimacy of the policymaking environment, and provide room for private sector investment that boosts growth.

It’s not a victory lap. It’s a preliminary evaluation. However, the signal is currently unmistakable. Nigeria has started to transform policy bravery into institutional advancement and quantifiable economic results under Wale Edun’s leadership.

The next challenge is to make those benefits more widespread and long-lasting so that reform becomes a long-term route to prosperity for all.

It is impossible to overestimate the combined impact of these advances. Nigeria is repositioning itself for the next stage of economic transition with greater growth, less inflation pressure, stronger external buffers, and strengthened institutional frameworks. However, there are still significant obstacles to overcome, such as closing infrastructural gaps, making sure that the average citizen benefits from reform, and maintaining the momentum of revenue and investment mobilization.

Edun has compared his work to that of a conductor coordinating several reforms while maintaining harmony and rhythm among institutional, monetary, and fiscal tools. Building the framework for long-lasting reform is just as important to his success as headline measures. The FATF delisting and the IMF growth updates are significant turning points, but the real effort lies in rebuilding confidence, implementing systems, and layering changes.

Let’s say Nigeria can now use this platform to deliver inclusive growth, draw in long-term capital, and strengthen structural reforms. If so, the accomplishments thus far will signal the start of what may turn out to be a long-term period of rebirth. Nigeria has established the groundwork under Wale Edun’s leadership; the next challenge is to expand upon it and establish reform-led growth as the new standard.