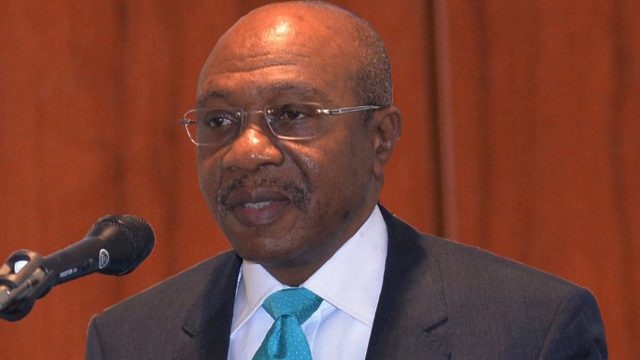

Godwin Emefiele, governor of the Central Bank of Nigeria (CBN), has urged risk professionals in the financial industry to broaden their risk management practices in the face of emerging risks.

Emefiele stressed the importance of financial institutions adapting and evolving their risk management frameworks to effectively address emerging risks and challenges during the inauguration of the Chartered Risk Management Institute of Nigeria (CRMI), formally known as the Risk Management Association of Nigeria (RIMAN).

He stated that, with the rapid advancement of technology and changing dynamics in the financial sector, risk professionals must broaden their expertise beyond traditional areas such as credit and liquidity risk.

Emefiele, who was represented by Dr. Blaise Ijebor, director of CBN’s Risk Management Department, also stated that CBN is committed to fostering a robust risk management culture within the industry by enabling the identification, assessment, and mitigation of risks at both institutional and system-wide levels.

Read Also: Photos: Atiku at PDP’s reception for newly elected, re-elected governors

“Since its inception, the Central Bank of Nigeria has increasingly emphasized the importance of financial institutions establishing risk and compliance teams.” Initially focusing on credit, liquidity, and prudential risk management, lessons learned from previous major risk events such as the Global Financial Crisis, as well as increased use of digital channels in the provision of financial services, have expanded the scope and practice of risk management in the Financial Services Industry.

“Today, we have very mature formal structures in place for identifying, assessing, and aggregating risks in order to form an enterprise-wide view of the risks associated with financial services and the Central Bank’s operations.” We have also put measures in place to effectively manage these risks.”

He went on to say that the evolution of risk management within the central bank led to the creation of the Risk Management Department in 2010; an attestation to its commitment and confirmation that the CBN’s management is willing to lead the industry from the front.

“We believe that implementing a strong risk management framework is critical to the Bank’s mandate and ensuring the stability of the Nigerian financial system.” “As you might expect, risk management remains a major consideration in many of the Central Bank of Nigeria’s key decisions and initiatives,” he said.

Read Also: Tinubu’s Spokesman, Rahman Bags MBA In Foreign Varsity

In addition, he stated that “the elevation of RIMAN to a Chartered Institute is a clear testament to your collective commitment to enhancing risk management practices in our country; through the provision of high-quality training and certification programme.”

As a result, he charged the institute with developing a pool of skilled risk management professionals who will aid in the development and implementation of effective risk management strategies and procedures that will aid in the containment of various types of risks and support the growth and stability of the financial system in today’s rapidly changing world.