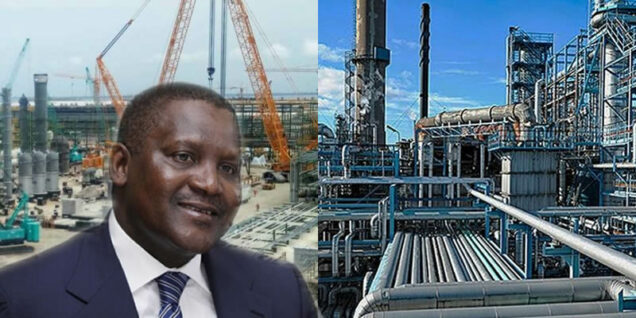

Stakeholders in the oil and gas industry are anticipating a significant improvement in the nation’s refining sector as the long-awaited Dangote refinery is set to open later this month.

President Muhammadu Buhari is expected to commission the oil refinery, putting it into operation for the first time since construction began in 2016.

The federal government confirmed the planned start-up of the 650,000-barrel-per-day refinery.

The company is currently putting the finishing touches on the inauguration, as operations are expected to be built up in phases.

Stakeholders interviewed by see the refinery as a solution to ending the country’s reliance on imports for nearly all of its refined petroleum products.

The multibillion-dollar Oil Refinery and Petrochemical Company will address Nigeria’s perennial refining problems.

Using this approach could help the federal government in its efforts to become self-sufficient in refining crude oil locally in order to save precious foreign exchange used in petroleum importation.

Dangote Refinery, the world’s largest single-train refinery, will produce up to 650,000 barrels per day, or 103,341,742 litres of refined petroleum product.

After years of delays, the Dangote refinery’s cost grew to $19 billion from initial estimates of $12 billion to $14 billion.

The Dangote Refinery complex, located in the Lekki Free Zone area of Lagos State, spans approximately 2,635 hectares, which is larger than the size of Lagos’ Victoria Island.

Its pipeline infrastructure is the world’s largest, with 1,100 kilometers capable of handling three billion Standard Cubic Feet per day (Scf/d) of gas due to the refinery’s large capacity.

According to reports, the refinery has a 435MW power plant that can meet the total power requirements of Ibadan Electricity Distribution Company (IBEDC).

Read Also: Gbajabiamila tasks Senators-elect, Members-elect to unimpeachable discourse at 10th NASS

According to Mayowa Afe, president/managing director at Danvic Petroleum International, one of the benefits the refinery will bring to the sector is adding value to crude oil that is exchanged for white products because local refineries are not operating at capacity.

Afe, a former president of the Oil and Gas Trainers Association of Nigeria (OGTAN), stated that once operational, the refinery will relieve pressure on scarce foreign exchange typically sourced from the parallel market.

“It is a good development and will add to the good things the outgoing administration has brought to the industry, as it will solve product importation and help address subsidy crises,” he added.

According to Olufemi Adewole, executive secretary of the Depot and Petroleum Products Marketers Association of Nigeria (DAPPMAN), with the development, depots will begin to operate at full capacity, resulting in increased investment in the industry.

According to Adewole, depot operators have had to contend with a lack of foreign exchange to bring in imported products into depot facilities, but because refining will be done in-country in a massive capacity given the size of the refinery, marketers will now have products to supply, which will also alleviate obstacles that have caused challenges in the sector.

Muda Yusuf, CEO of the Centre for the Promotion of Private Enterprise (CPPE), stated that this is a positive development for the oil and gas sector, adding that “this is one project many Nigerians have been looking forward to if only to save us from the depression of fuel importation and from challenges around our refinery and petroleum products.” This is a significant development for the economy, particularly the oil and gas industry.”

“This will relieve some of the pressure that the country has been experiencing around the importation of petroleum products; it may not completely eliminate the challenges of subsidy, but it will make it easier for us to engage on subsidy with stakeholders,” he said.

“Stakeholders have been clamoring for domestic refinery of petroleum products, and now that this has been accomplished, discussions about subsidy removal will be easier to handle, and this will be a major reform.”

Yusuf expressed hope that once the Dangote Refinery is commissioned and production begins, “we are hoping that this is not because the outgoing President is leaving and wants to commission before he leaves.” We hope that once the Refinery is completed, production will begin.”

Mr Adewale Oyerinde, the director-general of the Nigeria Employers’ Consultative Association (NECA), recently stated that if the country’s refineries were operational, subsidy would die naturally.

He contended that the country has the capacity to refine petroleum products that would meet its daily needs if the local refineries were operational and supplemented by the Dangote Refinery.

“If the refineries were operational,” he claims, “the country would probably not import fuel.” With the Dangote Refinery also on the horizon, we will most likely consider exporting. As a result, we are dealing with the issue of subsidy because we import fuel for domestic consumption.”

According to financial analysts, “Aliko Dangote estimated that Nigeria would save up to $10 billion in foreign exchange (FX) and generate another $10 billion in exports when the facility begins operation.”

They expect “the onboarding of the refinery to provide leverage for removing the long-overdue subsidy; guarantee the supply of petroleum products and other derivatives (such as Jet A1, Petcoke, Asphalt, and others) for Nigeria and neighboring countries; boost the growth of associated services and product supply chain partners; and break the NNPCL’s monopoly on product supply.”

“However, domestic refining from the Dangote refinery is not a guarantee for cheap petroleum products, nor is another round of subsidy regime, as the refinery is expected to get feedstocks at the prevailing international price but sell at a cost-reflected price in Naira equivalent.”

Read Also: Ahmad: Recognizing an Unusual Trailblazer at REA

Analysts also stated that the commissioning would not immediately translate to commercial refining and distribution, but “it signals the refinery’s readiness to begin operations in the third or fourth quarter of the year.”