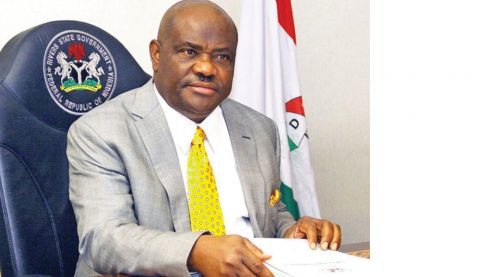

Barrister Nyesom Wike, the Minister of the Federal Capital Territory (FCT), has mandated the implementation of the FCT Internal Revenue Service Acts 2015 and the Personal Income Tax as a requirement for conducting business in Abuja, in an attempt to increase revenue in the nation’s capital.

According to Chinedum Elechi, the FCT Mandate Secretary for Economic Planning, Revenue Generation, and Public-Private Partnerships, the minister approved the implementation of Sections 31 of the FCT Internal Revenue Service Act, 2015, and 85 of the Personal Income Tax Act (PITA). Elechi made this disclosure to newsmen on Monday in Abuja.

He said that anyone found guilty of giving false information or getting a TCC through forgery or falsification would face a fine of N50,000, three years in prison, or both.

He continued by saying that a government body or organization that neglected to confirm a TCC prior to a transaction faces a punishment of N5,000,000, up to three years in prison, or both, if found guilty.

“All SDAs, corporate bodies, or any person empowered by law shall demand a TCC from any person or enterprise for the last three years preceding the current year of assessment as a precondition for transacting any business in the FCT,” he stated, citing Section 31 of the FCT-IRS Act.

Read Also: UK court overturns $11 billion damages bill for collapsed gas deal against Nigeria

The Certificate of Occupancy, contract awards, construction plan approvals, FCTA loan applications for business, housing, or other purposes, vehicle registration, land applications, and a plethora of other transactions are among the aforementioned transactions.

“Everyone must pay their fair share of taxes because they are the cornerstone of any government,” he declared. It is a civic obligation and responsibility to pay taxes. Ensuring that all eligible taxpayers in the FCT fulfill their tax duties is the goal of putting these rules into effect.

The minister, in a signed memo, stated: “The Federal Capital Territory Administration (FCTA) has noted with dismay the lack of application and observance of the provisions of Section 31 of the Federal Capital Territory Internal Revenue Service Act, 2015 and Section 85 of the Personal Income Tax Act (PITA), 2011 (as Amended), which call for the requirement and verification of Tax Clearance Certificates (TCC) from residents of the FCT prior to the performance of transactions or the rendering of services.

It is important to remember that the Federal Capital Territory Internal Revenue Service Act, 2015 and the Personal Income Tax Act (PITA) 2011 (as amended) both stipulate that before providing services or carrying out any transactions, Ministries, Departments and Agencies (MDAs), Commercial Banks, Secretariats, Departments & Agencies (SDAs) of the Federal Capital Territory Administration (FCTA), as well as Area Councils, corporate bodies, and statutory authorities, among others, must request and verify TCC from residents.For the avoidance of doubt, the Federal Capital Territory Internal Revenue Act 2015, Section 31(5), states that “a tax clearance certificate for the three (3) years immediately preceding the current year of assessment as a pre-condition to transacting any business including but not limited to…,” must be obtained by any department, agency, or FCTA official, any Area Council official, corporate body, statutory authority, or person empowered in that regard by this Act or any other law. and will consult the issuing tax authority to confirm the authenticity.

Consequently, before conducting any business transactions, all MDAS, SDAs, commercial banks, corporate, and statutory organizations operating within the Federal Capital Territory (FCT) are required to immediately enforce the provisions of the current laws by requesting current Tax Clearance Certificates from individuals, business names/enterprises, and organizations for the last three (3) years, and verifying with the FCT-Internal Revenue Service for those transactions listed in the schedule attached to this Circular as ANNEX 1.

According to section 85(9) of the PITA, 2011 (as amended), “Any official of MDAs, SDAs, FCTA officials, Area Council officials, corporate body, statutory Authority, or Commercial Banks who violates and fails to comply with the provision is guilty of an offense and is liable on conviction to a fine of N5,000,000.00 or to imprisonment for three years or both fine and imprisonment.”

“Please make sure everyone involved is aware of the contents of this circular so they can be put into effect right away.”